Mergers and Acquisitions

Fine Wine, Cheese and M&A?

Originally posted 1/22/21, no content changes. What do wine and cheese have to do with M&A? Well, unlike fine wine…

Read MoreFigure These Two Things Out Before You Sell Your Business

Originally posted 12/20/2019, no content changes. Your business is in good shape and you’re feeling ready to sell. You have…

Read MoreDon’t Use an M&A Attorney for an Investment Banker’s Job

Originally posted 10/3/2019, no content changes. Most people will never experience a merger, acquisition, or other business transaction firsthand. Of…

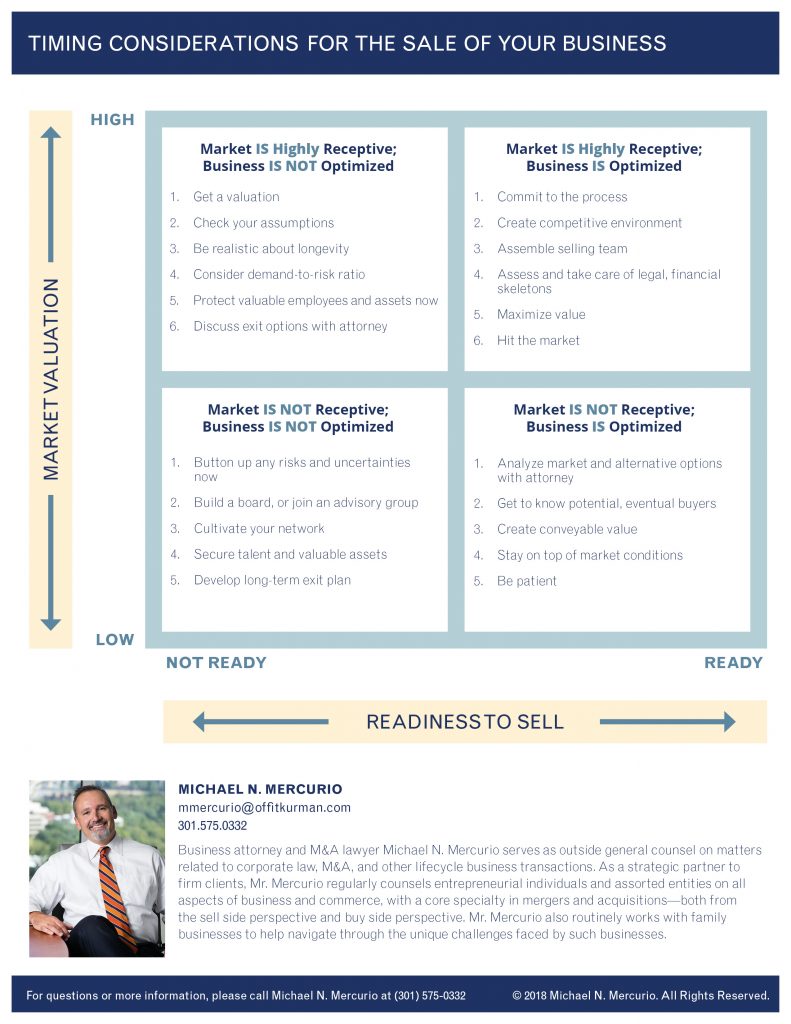

Read MoreM&A Market Opportunity: Is Now The Right Time To Sell Your Business? [Infographic]

Is now the right time to sell your business? Just as every business is unique, so is every sale. Some…

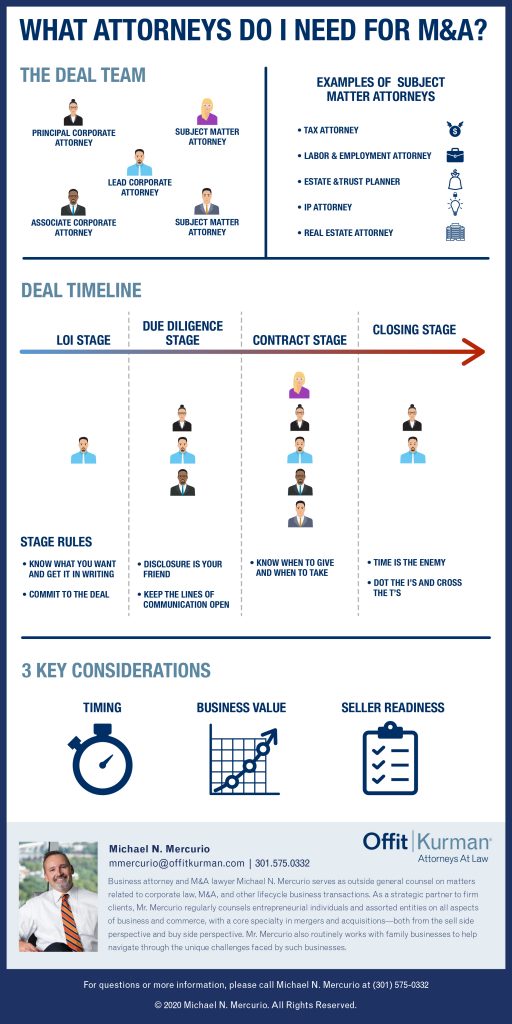

Read MoreInfographic: The Sell Side M&A Attorney Team

Mergers and acquisitions (M&A) are a team sport. It takes multiple people to successfully close a business transaction: the business owner or owners, the buyer, each side’s accountants and advisors, and multiple attorneys working together.

Read MoreIs your M&A Attorney an Advisor or a Consultant?

Originally posted on 12/4/2020. For many people, selling a business is their largest, lifetime financial transaction. And typically, it is…

Read More3 Questions and 3 Pieces of Advice: In a Hot M&A Market, Is Now the Time to Sell Your Business?

The M&A market has been very robust over the last few years. This year the market is still receptive to…

Read MoreM&A: Matching Priorities – Buyer and Seller

In the context of M&A, frequently the priorities of a buyer and a seller differ, especially at the outset of…

Read MoreM&A Nuggets: The Little Things Can Add Up

Most of the time and effort on an M & A transaction is rightfully devoted to the big ticket items…

Read MoreM&A Nugget: The Letter of Intent Tug of War

Originally posted on 7/24/22, content updated on 1/11/24 Here is the scenario – you have been discussing the sale of…

Read More