Legal Blog

Employee Classification: Recent California Developments

The battle over employee classification in California has been a long one, and there is still uncertainty surrounding the future of independent contractor vs. employee classification in the state. One sector this impacts greatly is the gig economy, with companies such as Uber, Lyft, DoorDash, and Instacart awaiting a major decision that could have serious implications.

The battle over employee classification in California has been a long one, and there is still uncertainty surrounding the future of independent contractor vs. employee classification in the state. One sector this impacts greatly is the gig economy, with companies such as Uber, Lyft, DoorDash, and Instacart awaiting a major decision that could have serious implications.

The Background of Employee Classification in California

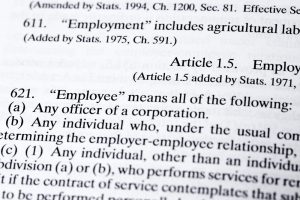

Employee classification in California long relied on the Borello test, which came from a 1989 Supreme Court case. This was a multifactor case that focused on how much control the employer had over the manner and means by which the employee performed their work. However, in 2018, the Dynamx decision changed all that when the California Supreme Court adopted the ABC test for determining whether an employee was an independent contractor or an employee under California law.

Post Dynamex, a worker is categorized as an employee unless the company can prove that A) the worker is free from the control and direction of the hiring entity in connection with the performance of the work; B) The worker performs work outside the usual course of the hiring entity’s business; and C) The worker is also engaged in an independently established trade or business that is of the same nature they are performing for the hiring entity.

AB5 was then signed in 2019 in California, codifying the decision in Dynamex. This became law in 2020, expanding the application of the ABC test to most workers and making it even more difficult for companies to classify workers as independent contractors.

The Impact on the Gig Economy

Because of the nature of the gig economy, this has had a significant impact on employers within the industry. These companies relied heavily on the ability to classify their workers as independent contractors, avoiding the benefits and employment regulations that come along with employee classification (such as insurance, overtime, and minimum wage requirements). So, it is no surprise that lawsuits and ballot measures followed AB5.

Many gig economy companies also sponsored Proposition 22, which was a ballot initiative that exempted app-based transportation and delivery companies from AB5. California voters approved the measure in 2020, allowing these companies to continue classifying their workers as independent contractors.

Recent Developments

The passage of Proposition 22 is not where this story ends. There have, of course, been legal challenges, with a judge ruling it unconstitutional in 2021. That decision has been appealed, and we are waiting for a decision from the California Supreme Court this summer. AB5 has also been challenged in the courts, with Uber and Postmates claiming the law violated their rights under the Equal Protection Clause of the state and US constitutions. However, the 9th Circuit disagreed, recently blocking their efforts to overturn the law.

This latest failure for Uber in the courts means gig economy companies must rely on the California Supreme Court to uphold Proposition 22 in order to continue classifying employees as independent contractors.

Broader Implications

While it might seem that this only impacts companies in this space in the state of California, this does have some broader implications to consider. It highlights the real issues that exist surrounding innovation and employment law. The technology that allows these companies to operate outpaced developments in regulations and legislation governing companies and workers in this space. And while it attempts to “catch up,” the legal battles have left a great deal of uncertainty for both sides.

We will be watching for the California Supreme Court’s decision on Proposition 22 that should come down in the next few months and will update on the future of employee classification in the state and what companies need to know at that time.

ABOUT DEBORAH PETITO

|

|

Deborah (“Debbie”) Petito is a Principal attorney in the firm’s Labor & Employment, Estates and Trusts and Litigation practice groups.

Debbie has practiced in the labor and employment field for over 35 years. Her practice focuses on all types of employment matters, including employment litigation (discrimination, harassment and wage and hour) in federal and state courts, before state and federal agencies regulating wages and hours of employment and in arbitration proceedings and labor matters (dealing with unions and union-related issues). She acts as an outside employment counsel to several companies in various industries providing advice on an ongoing basis. She also conducts investigations, provides general advice and counsel to employers on employee discipline and termination, wage and hour issues as well as other employment topics. Debbie frequently speaks on labor and employment issues.