Franchise Alchemy

Government Agencies: Franchise

- California

- California Document Quality Network Portal

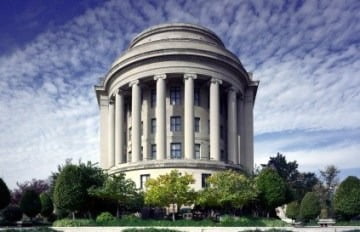

- Federal Trade Commission

- Hawaii

- Illinois

- Indiana

- Maryland

- Michigan

- Minnesota

- Minnesota CARDS (Commerce Actions & Regulatory Documents Search)

- Nebraska

- New York

- North Dakota

- Oregon

- Rhode Island

- South Dakota

- Virginia

- Washington

- Wisconsin

- Wisconsin E-Filing

Selected Government Agencies: Business Opportunities

National Organizations

- American Bar Association (ABA) Forum on Franchising

- International Franchise Association (IFA)

- North American Securities Administrators Association (NASAA)

International Organizations

What’s a Biz Op?

What’s a business opportunity or, as we often say, a “biz op”? The Federal Trade Commission (FTC) regulates biz op sales under its authority to regulate unfair or deceptive trade practices. The FTC’s definition of a business opportunity differs from the definitions under the laws of the 26 states that regulate biz ops, and the states themselves have varying definitions. These laws impose anti-fraud obligations on the sellers of biz ops, and some require registration and disclosure. This post covers the FTC biz op rule (16 CFR Part 437). A separate post will address state biz op laws.

What’s a business opportunity or, as we often say, a “biz op”? The Federal Trade Commission (FTC) regulates biz op sales under its authority to regulate unfair or deceptive trade practices. The FTC’s definition of a business opportunity differs from the definitions under the laws of the 26 states that regulate biz ops, and the states themselves have varying definitions. These laws impose anti-fraud obligations on the sellers of biz ops, and some require registration and disclosure. This post covers the FTC biz op rule (16 CFR Part 437). A separate post will address state biz op laws.

The FTC began regulating the sale of biz ops throughout the U.S. in 1979 with the issuance of a trade regulation rule on franchising and business opportunities. In 1995, the FTC began a regulatory review of the 1979 rule. That review led to a new FTC franchise rule in 2007 and a separate new FTC business opportunity rule in 2012 in light of the significant differences between franchises and biz ops. The FTC staff report of November 8, 2010, noted that “franchises typically are expensive and involve complex contractual licensing relationships, while business opportunity sales are often less costly, involving simple purchase agreements that pose less of a financial risk to purchasers.” Accordingly, biz op offerings are subject to less imposing and costly compliance requirements.

A “business opportunity” under the FTC rule means a commercial arrangement in which (i) the seller solicits a prospective purchaser to enter into a new business; (ii) the prospective purchaser makes a required payment; and (iii) the seller represents, expressly or by implication, orally or in writing, that the seller or its designee will do any one of the following:

- provide locations for the use or operation of equipment, displays, vending machines or similar devices owned, leased or paid for by the purchaser; or

- provide outlets, accounts or customers for the purchaser’s goods or services; or

- buy back the goods or services that the purchaser makes or provides.

Unlike the FTC franchise rule, the required payment under the FTC biz op rule does not exclude purchases for less than $500. But like the franchise rule, payments for reasonable amounts of inventory at bona fide wholesale prices are not counted toward the required payment for a business opportunity. Franchises are exempted from the FTC’s biz op rule.

The FTC business opportunity rule requires the biz op seller to provide to each prospective purchaser a one-page disclosure document at least seven calendar days before a prospective purchaser may sign any documents or pay any money to the seller. The disclosure document includes yes and no answers to the following questions:

- Has the seller or any of its affiliates or key personnel been the subject of a civil or criminal action involving misrepresentation, fraud, securities law violation or unfair or deceptive practices within the past 10 years? If yes, the seller must attach a list and brief descriptions of all such legal actions.

- Does the seller offer a cancellation or refund policy? If yes, the seller must attach a statement describing the policy.

- Has the seller or its salesperson discussed how much money a purchaser can earn or purchasers have earned? Have they stated or implied that purchasers can earn a specific level of sales, income or profit? If yes, the seller must attach an earning claims statement, as explained below.

A biz op seller has the option to make an earnings claim or not. An earnings claim includes, among other things:

“(1) any chart, table, or mathematical calculation that demonstrates possible results based upon a combination of variables; and

(2) any statements from which a prospective purchaser can reasonably infer that he or she will earn a minimum level of income (e.g., “earn enough to buy a Porsche,” “earn a six-figure income,” or “earn your investment back within one year”).” (14 CFR §437.1(f).)

The seller must have a reasonable basis for any earnings claim it makes, and the seller must have written materials that substantiate the claim at the time it is made. The seller must make the written substantiation available upon request to the prospective purchaser.

The earnings claim itself must state the beginning and ending dates when the represented earnings were achieved and the number and percentage of all purchasers who achieved at least the stated level of earnings during the indicated period.

The disclosure document must also include the names and telephone numbers of all people who have purchased the business opportunity within the last three years. If there are more than 10, the disclosure document may optionally include the 10 that are nearest to the prospective purchaser’s location.

The purchaser signs and dates a duplicate copy of the disclosure document and sends it to the seller to evidence the disclosure.

There is no federal filing requirement for biz ops, just as there is none for franchises.

Tom Pitegoff,

Tom.Pitegoff@offitkurman.com